By Keli James • Real Estate Consultant, SimpliHŌM • S.56134 LLC • LVLocalGuide.com

If you’ve been watching Las Vegas home prices climb, here’s some good news: the federal government just gave our market a little breathing room.

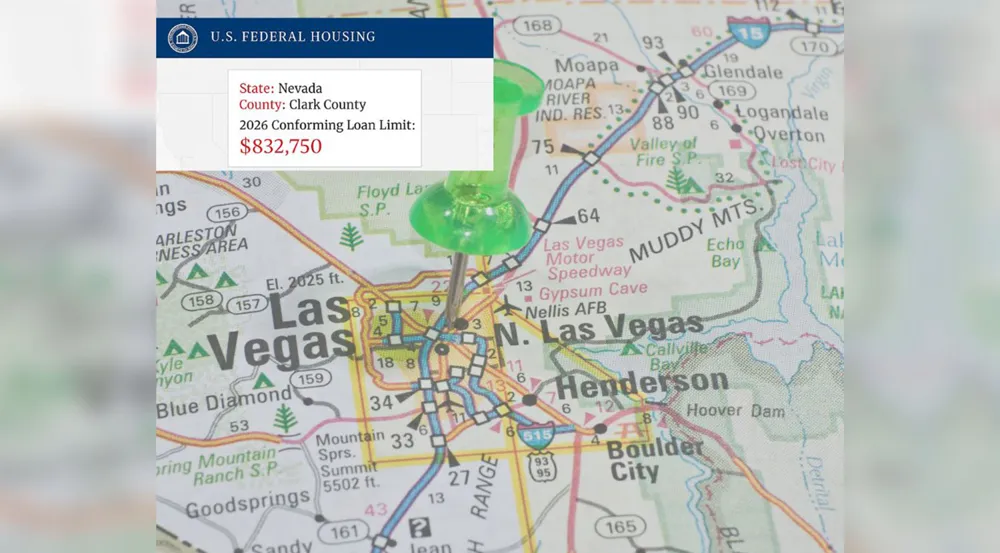

The Federal Housing Finance Agency (FHFA) announced the new 2026 Conforming Loan Limits, and Clark County is getting a bump — making it easier for buyers to qualify for higher-priced homes without crossing into jumbo-loan territory.

And in a city where $500k–$900k homes are the norm in neighborhoods like Summerlin, The Lakes, Peccole Ranch, and Henderson’s most popular communities? This is a big deal.

The New 2026 Loan Limit for Las Vegas & Henderson

For Clark County (Las Vegas–Henderson–North Las Vegas):

New 2026 Conforming Loan Limit:

$832,750

(Up from $806,500 in 2025)

That’s more than a $26,000 increase — directly tied to rising home prices in the FHFA Home Price Index.

This means buyers can borrow more without entering a jumbo loan, which usually comes with:

- Higher credit score requirements

- Bigger down payments

- Stricter underwriting

- Higher interest rates

Plus, homeowners with a current jumbo loan may finally be able to refinance into a Conventional loan and potentially save money.

Is Las Vegas a High-Cost Area?

No — not yet.

Some areas like NYC and Silicon Valley qualify as “high-cost,” pushing their limits over $1.24M. Las Vegas isn’t in that category, but with steady growth and rising values, the annual increases are helping buyers stay competitive.

Loan limits rise when home prices rise. The FHFA saw a 3.26% increase nationally from Q3 2024 to Q3 2025 — and the new limits reflect that.

Why This Matters for Las Vegas Buyers

If you’re shopping in the $700k–$900k range, this limit increase lets you:

- Get a Conventional loan with as little as 3–5% down

- Avoid jumbo loan pricing

- Keep monthly payments lower than expected

- Stay competitive against cash buyers and investors

This is especially helpful with Las Vegas inventory tightening and demand increasing from California and other relocation markets.

Why This Also Matters for Las Vegas Homeowners

If you bought your home with a jumbo loan, you might now qualify to refinance into a Conventional loan. That can mean:

- Lower interest rates

- Easier qualifications

- More loan options

- Savings over the life of the loan

This applies whether you’re staying put or preparing to sell.

What About VA Buyers?

These loan limits don’t impact VA buyers in the same way (VA loans do not technically have loan limits for qualified buyers). However, higher conforming limits can reduce lender overlays and make approvals smoother in mid-luxury and luxury segments.

Veterans shopping near $800k will benefit from this adjustment.

Las Vegas Is Still One of the Most Affordable Major Markets

Even with growth, Las Vegas remains more affordable than many metros with similar amenities, including:

- World-class entertainment

- Two professional sports teams (soon three)

- Outdoor lifestyle (Red Rock, Lake Mead, Mount Charleston)

- Retiree-friendly tax climate

- Major job growth in tech, hospitality, logistics, and healthcare

Higher loan limits simply make it easier for buyers to compete in mid-to-high-end price ranges.

Thinking About Buying or Refinancing? Let’s Chat.

Whether you want to know:

- What you qualify for now

- Whether refinancing makes sense

- How this affects your move-up plans

- What your home is worth in today’s market

I can help.

Get your free home valuation: https://LVLocalGuide.com/selling

Or reach out directly:

Keli James

Real Estate Consultant, SimpliHŌM

S.56134 LLC

Phone: 702-265-4323

Email: KeliJamesLV@gmail.com

Website: LVLocalGuide.com